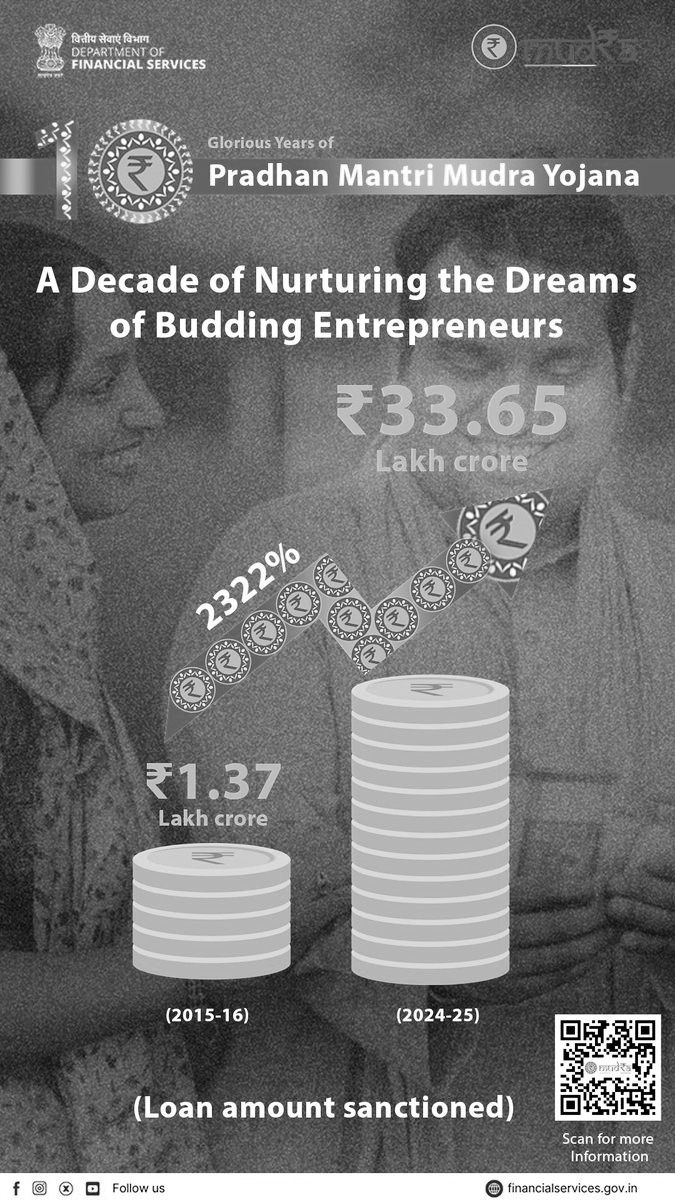

The Pradhan Mantri MUDRA Yojana (PMMY), launched by Prime Minister Narendra Modi on April 8, 2015, recently marked its 10th anniversary, empowering small and micro-entrepreneurs in India. Focused on financial inclusion, the scheme offers collateral-free loans up to ₹10 lakh for non-corporate, non-farm activities, with a recent increase to ₹20 lakh as announced in the Union Budget 2024-25. The new Tarun Plus category targets individuals who have successfully repaid previous loans under Tarun. The Credit Guarantee Fund for Micro Units (CGFMU) supports these loans, underscoring the government’s dedication to entrepreneurship. PMMY has enhanced credit availability to Micro, Small, and Medium Enterprises (MSMEs), benefiting marginalized communities with over ₹33.65 lakh crore sanctioned across 52 crore loan accounts. Notably, 68% of loans have gone to women, promoting their entrepreneurship. The government, through the initiative, aims to foster self-employment and reduce dependence on informal lenders, contributing to a developed India by 2047 through financial inclusion and economic growth.

Pradhan Mantri Mudra Yojana (PMMY) marks a decade of empowering financial inclusion through three core pillars: Banking the Unbanked, Securing the Unsecured, and Funding the Unfunded. It provides collateral-free credit access and promotes collaboration within the financial ecosystem. Loans under PMMY are categorized into four segments: Shishu (up to ₹50,000), Kishor (above ₹50,000 to ₹5 lakhs), Tarun (above ₹5 lakhs to ₹10 lakhs), and Tarun Plus (₹10 lakhs to ₹20 lakhs), catering to diverse financing needs across sectors, including agriculture. Interest rates align with RBI guidelines, with flexible repayment options available.

As of March 21, 2025, PMMY achieved substantial disbursements, such as ₹8.49 lakh crore for women under Shishu, ₹4.90 lakh crore under Kishor, and ₹0.85 lakh crore under Tarun. Minority borrowers received ₹1.25 lakh crore (Shishu), ₹1.32 lakh crore (Kishor), and ₹0.50 lakh crore (Tarun). A total of 52.37 crore loans worth ₹33.65 lakh crore have been sanctioned since launch, amplifying the government’s commitment to financial inclusion and entrepreneurship in India.